Are you looking for financial advice but feeling overwhelmed by all the options out there? A chartered financial planner might be the answer you’re looking for. These professionals are experts in financial planning, providing tailored advice to help you reach your financial goals.

With their extensive training and qualifications, chartered financial planners can offer holistic advice on a wide range of financial matters. From investments and pensions to tax planning and estate management, they have the knowledge and expertise to help you make informed decisions about your money.

what is chartered financial planner

What is a Chartered Financial Planner?

A chartered financial planner is a highly qualified professional who has met rigorous standards set by the Chartered Insurance Institute (CII). They adhere to a strict code of ethics and professional conduct, putting your best interests first at all times.

When you work with a chartered financial planner, you can expect personalized advice that takes into account your unique circumstances and goals. They will work with you to create a financial plan that aligns with your objectives, helping you to secure your financial future.

Whether you’re planning for retirement, saving for a big purchase, or looking to protect your family’s financial security, a chartered financial planner can provide invaluable guidance. By working with one of these professionals, you can feel confident that you’re making sound financial decisions that will benefit you in the long run.

So if you’re feeling lost in the world of finance, consider reaching out to a chartered financial planner for guidance. Their expertise and personalized advice can help you navigate the complexities of financial planning and secure your financial future.

Change Of Logo Chartered Financial Planner TM Asset Management

Chartered Financial Planner Explained YouTube

Chartered HFMC Wealth

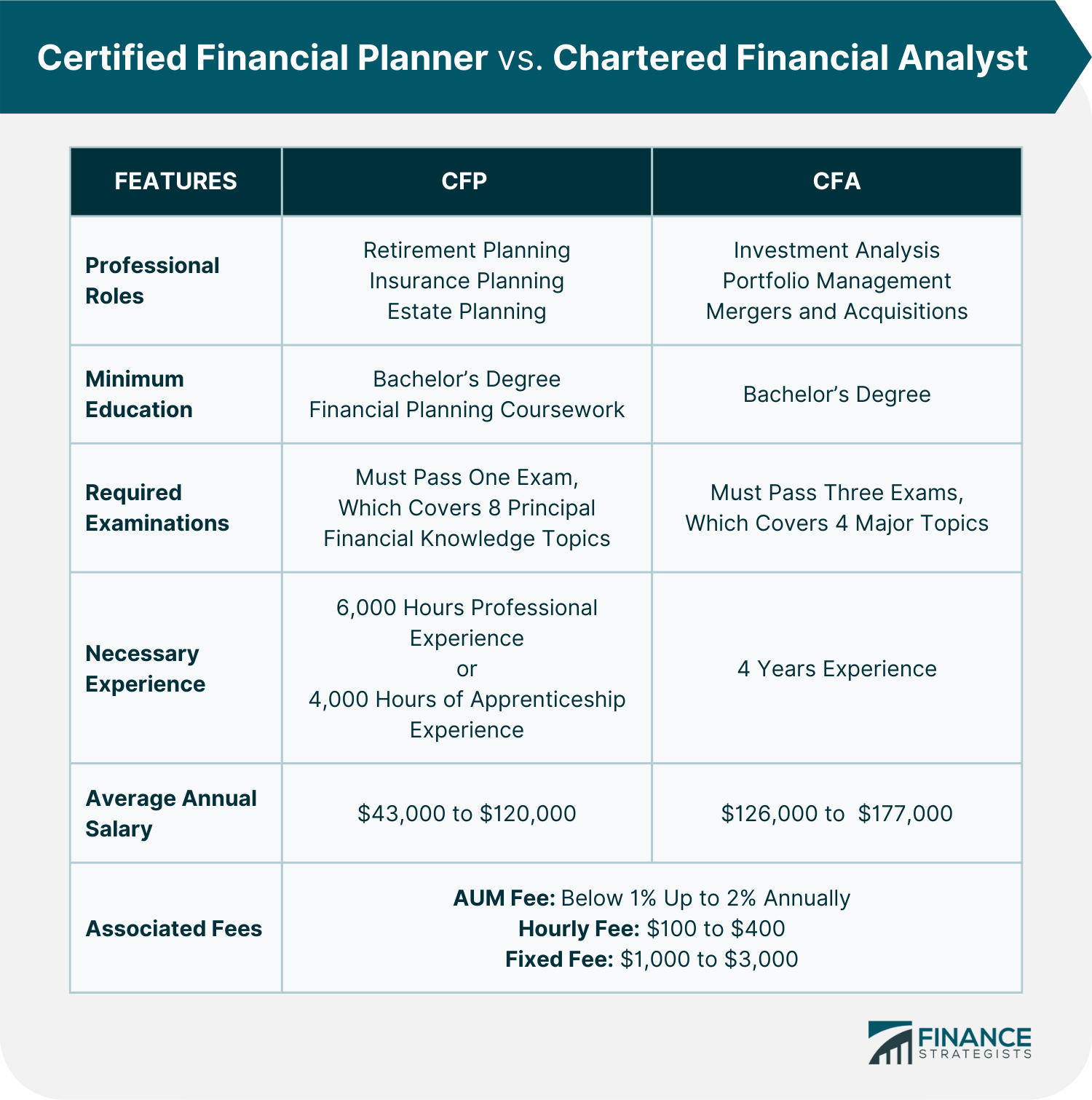

Certified Financial Planner CFP Definition Duties Selection

Chartered Financial Planner Merrick Financial Services