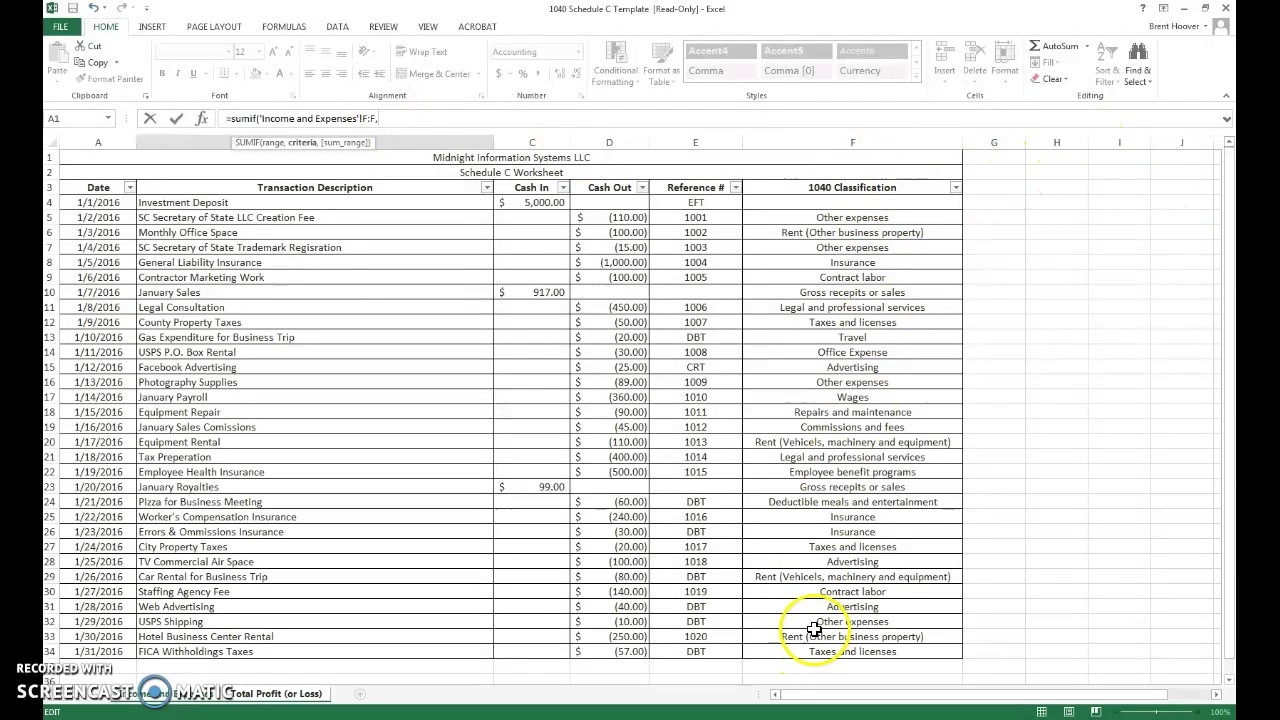

Are you a small business owner looking to manage your expenses more effectively? Keeping track of your Schedule C expenses is crucial for tax purposes and overall financial health. By using a Schedule C expenses worksheet, you can simplify the process and stay organized.

With a Schedule C expenses worksheet, you can categorize your expenses, track your spending, and ensure you’re taking advantage of all possible deductions. This tool can also help you identify areas where you may be overspending or where you can cut costs.

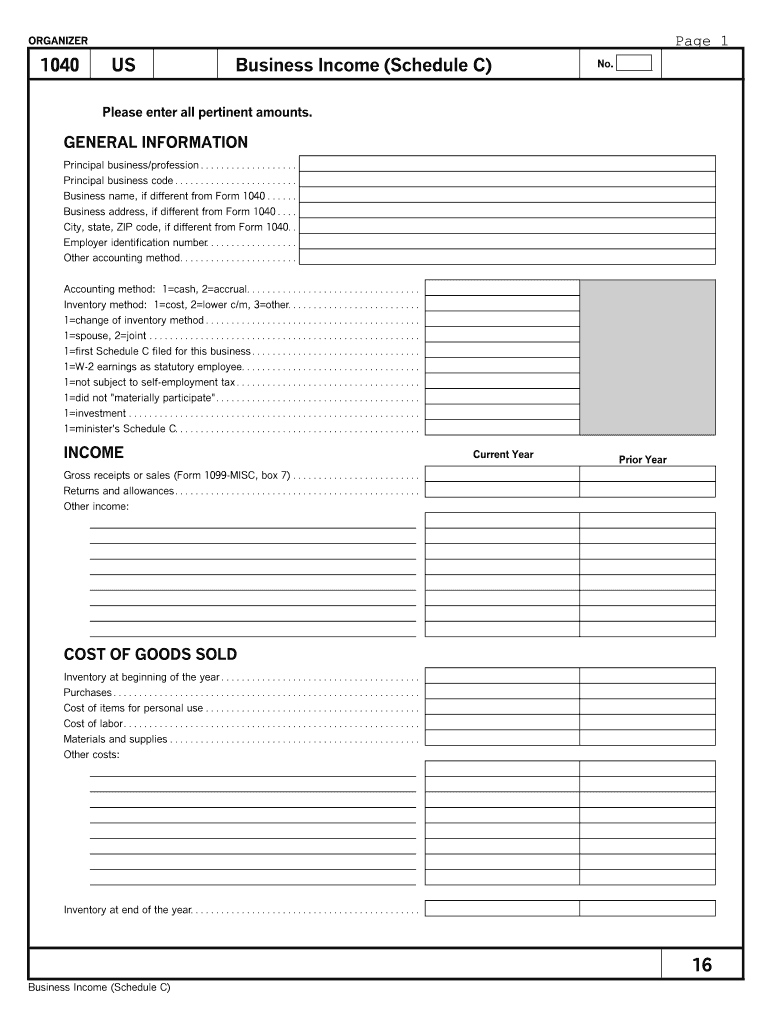

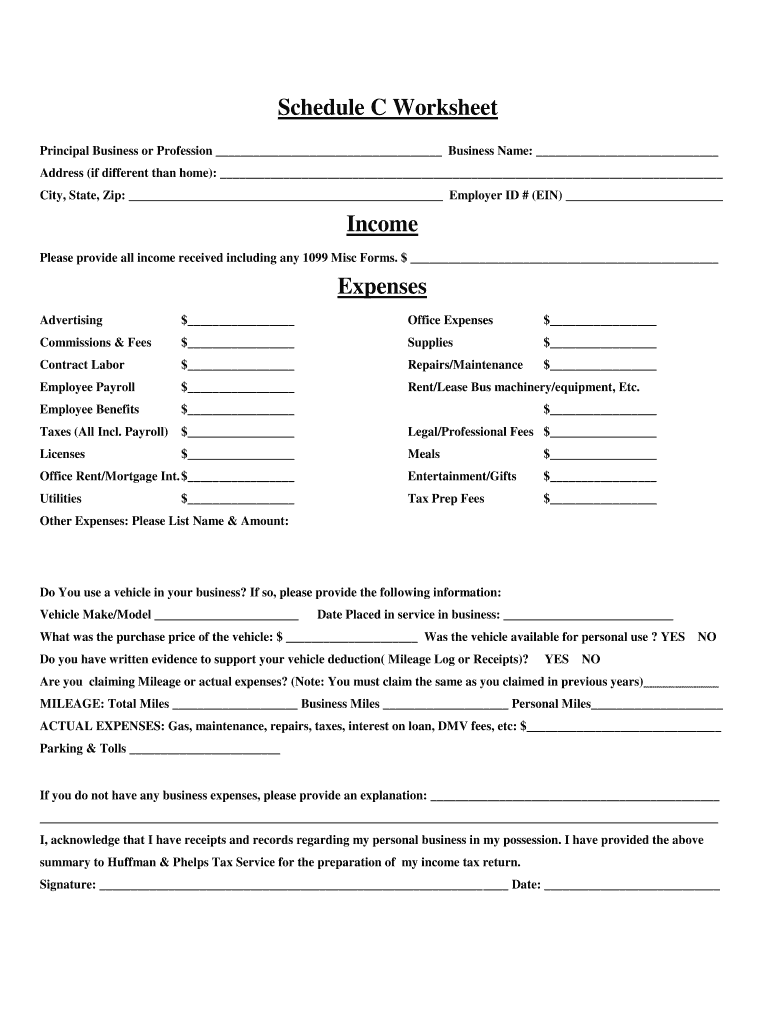

schedule c expenses worksheet

Managing Your Finances with a Schedule C Expenses Worksheet

Start by creating categories for your expenses such as office supplies, travel, utilities, and more. Keep all your receipts and invoices organized and up to date. This will make it easier to fill out your Schedule C at tax time and avoid any potential headaches.

Make sure to review your worksheet regularly to see where your money is going. Are there any areas where you can reduce expenses? Are there any deductions you may have missed? By staying on top of your finances, you can make informed decisions and improve your bottom line.

Remember, a Schedule C expenses worksheet is a tool to help you manage your business finances more efficiently. Don’t let it become a burden. Stay consistent with your record-keeping, and you’ll thank yourself come tax season.

In conclusion, using a Schedule C expenses worksheet can make a big difference in how you manage your small business finances. By staying organized and proactive, you can maximize your deductions, reduce your tax liability, and set yourself up for success in the long run.

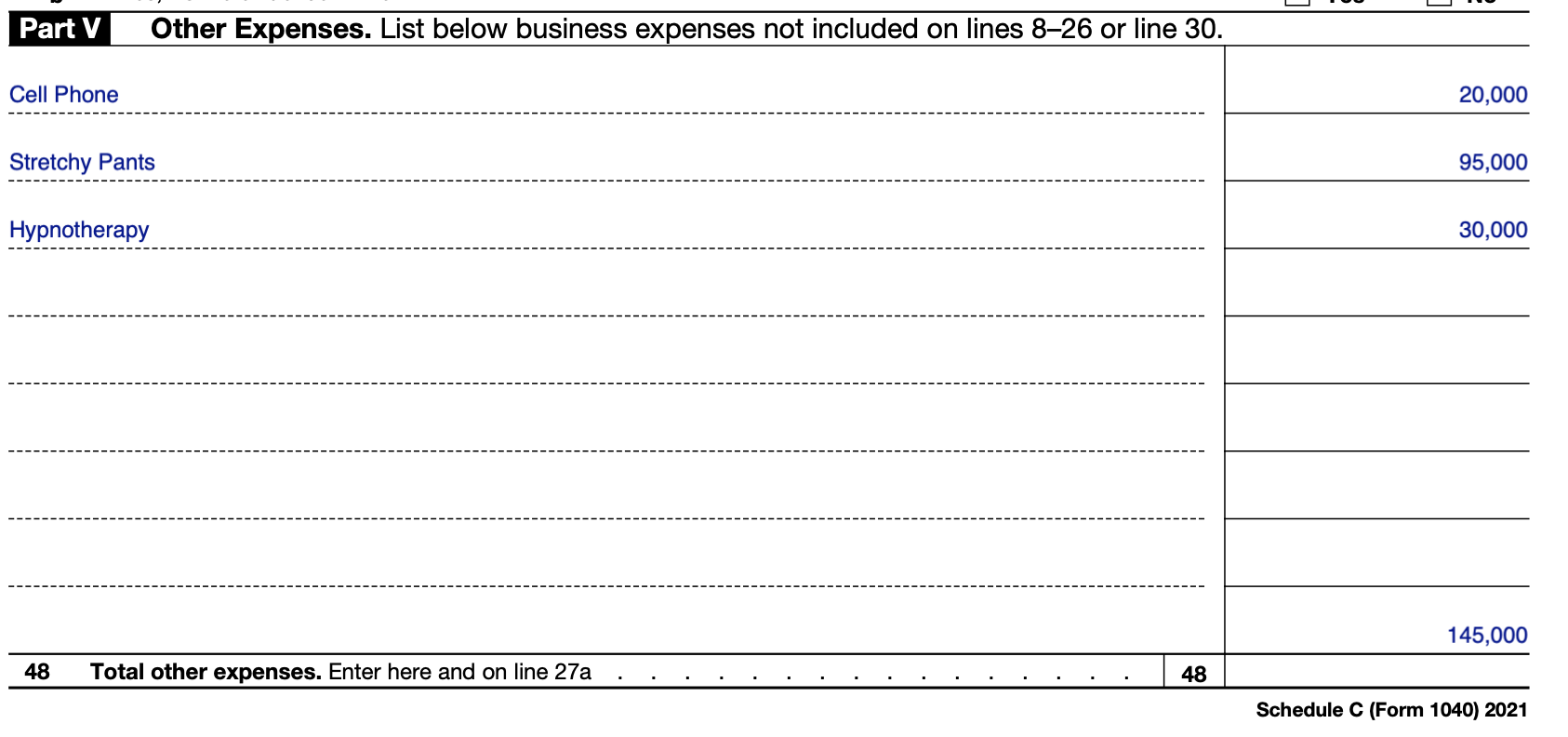

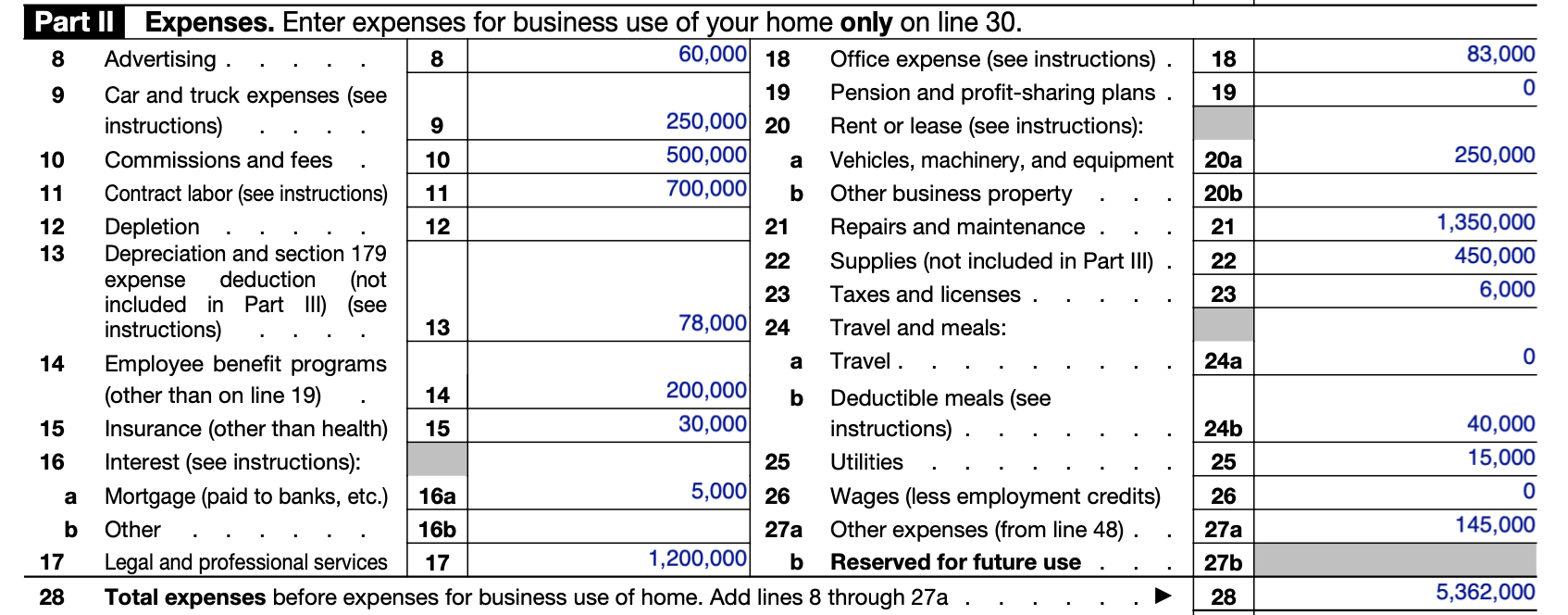

How To Fill Out Your Schedule C Perfectly With Examples

How To Fill Out Your Schedule C Perfectly With Examples

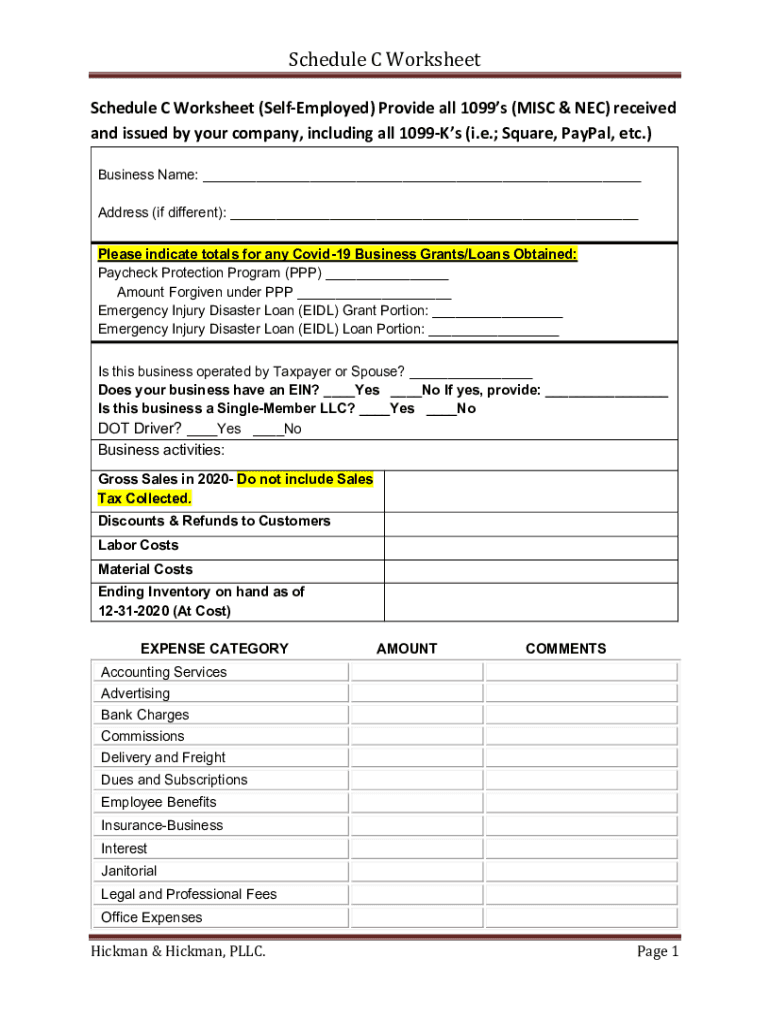

1099 Schedule C Fill Out Sign Online DocHub

Schedule C Expenses Worksheet Fill Out Sign Online DocHub

Schedule C Expenses Worksheet Fill Out Sign Online DocHub