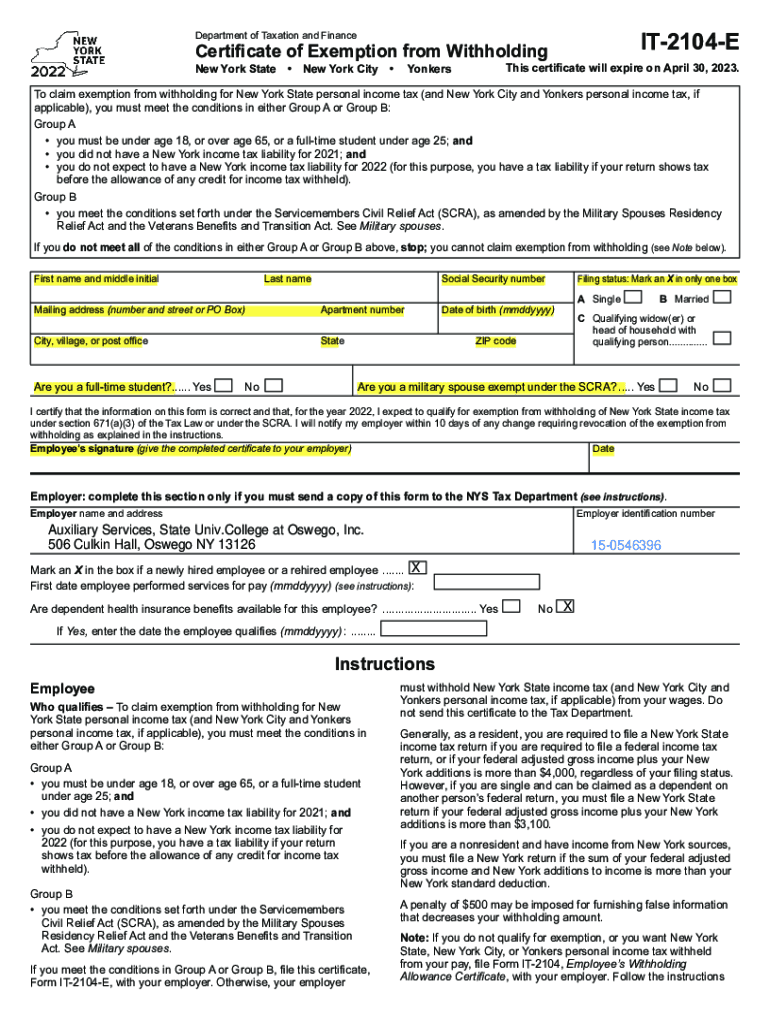

Are you looking for a simple way to organize your tax information? The it-2104 worksheet can help you do just that. This handy tool allows you to keep track of your income and deductions in a clear and organized manner.

By using the it-2104 worksheet, you can easily calculate your tax liability and ensure that you are taking advantage of all available deductions and credits. This can help you maximize your tax refund or minimize any amount due at tax time.

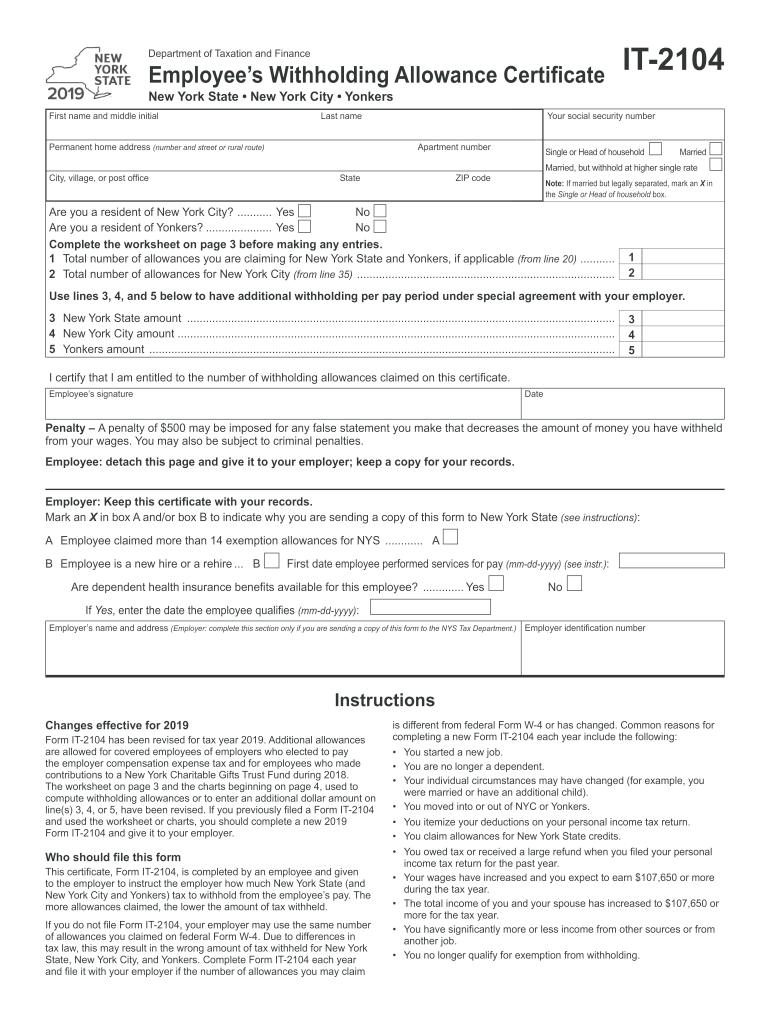

it-2104 worksheet

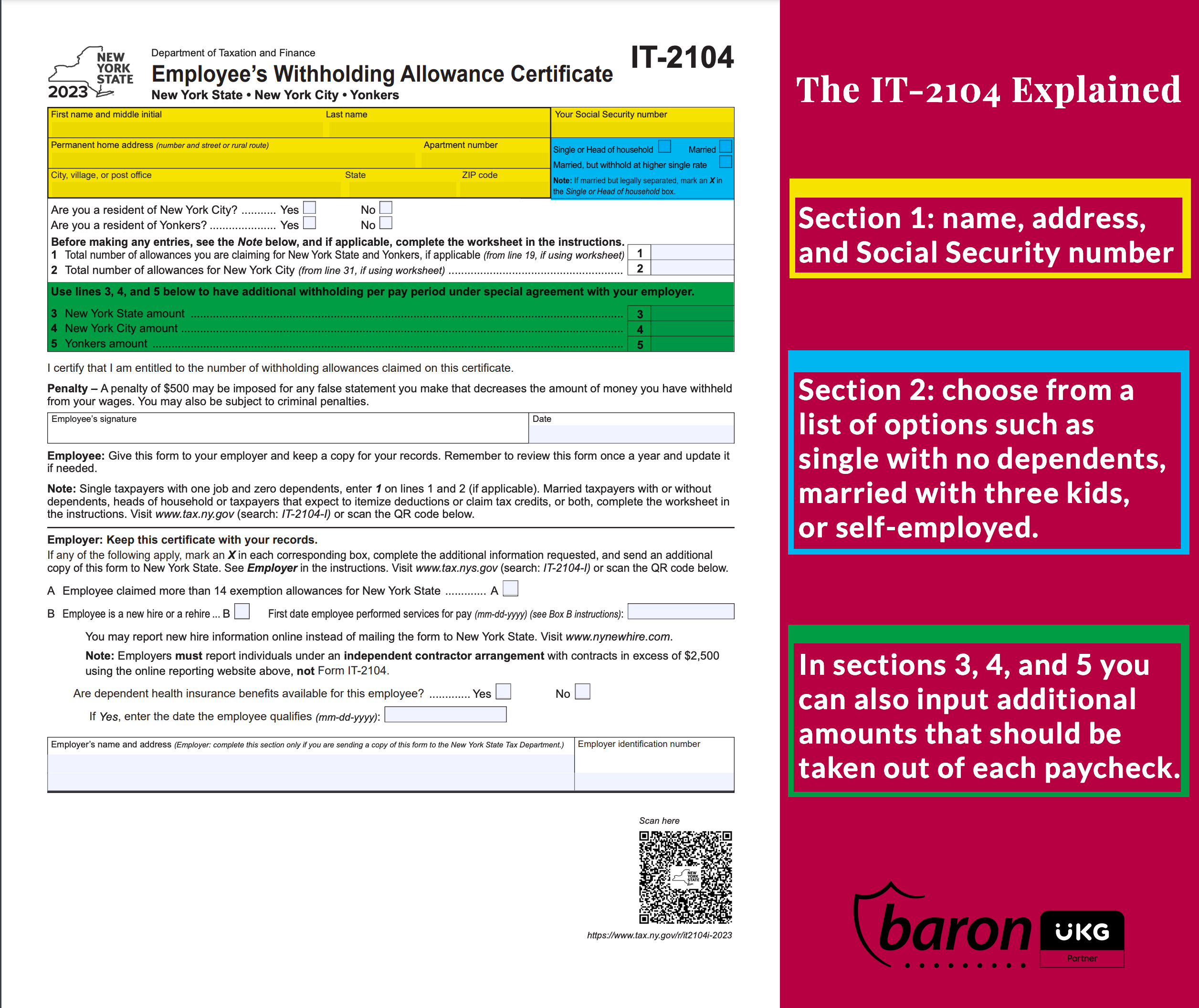

How to Use the it-2104 Worksheet

To get started with the it-2104 worksheet, simply gather all of your income and deduction information. Then, input these figures into the appropriate sections of the worksheet. Be sure to double-check your entries to ensure accuracy.

Once you have completed the worksheet, review the results to see if there are any areas where you can make adjustments to reduce your tax liability. You may also want to consult with a tax professional to ensure that you are taking advantage of all available tax breaks.

Using the it-2104 worksheet can help you stay organized and on top of your tax obligations. By keeping detailed records and utilizing this tool, you can make tax time less stressful and ensure that you are not missing out on any potential tax savings.

In conclusion, the it-2104 worksheet is a valuable resource for anyone looking to streamline their tax preparation process. By using this tool, you can keep track of your income and deductions in a clear and organized manner, helping you maximize your tax refund or minimize any amount due at tax time.

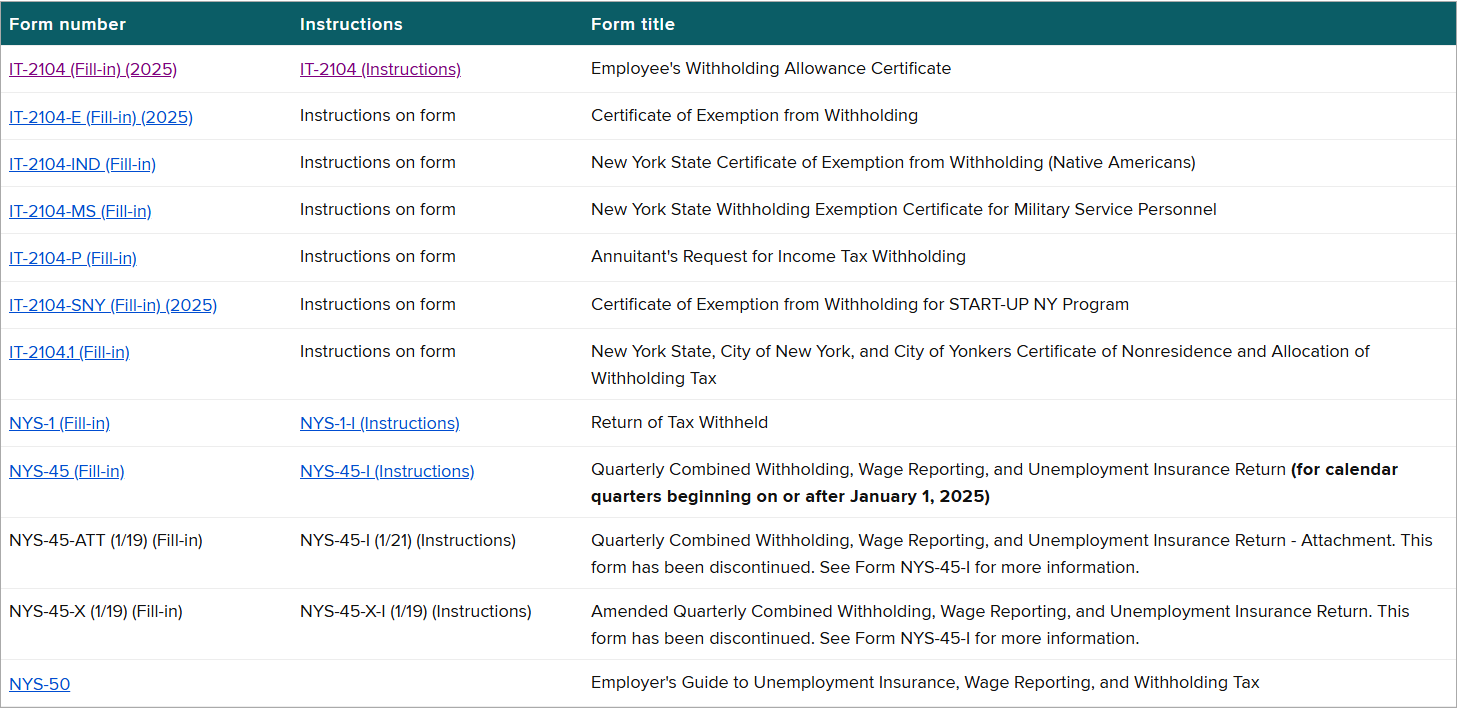

2020 2025 Form NY DTF IT 2104 1 Fill Online Printable Fillable Blank PdfFiller

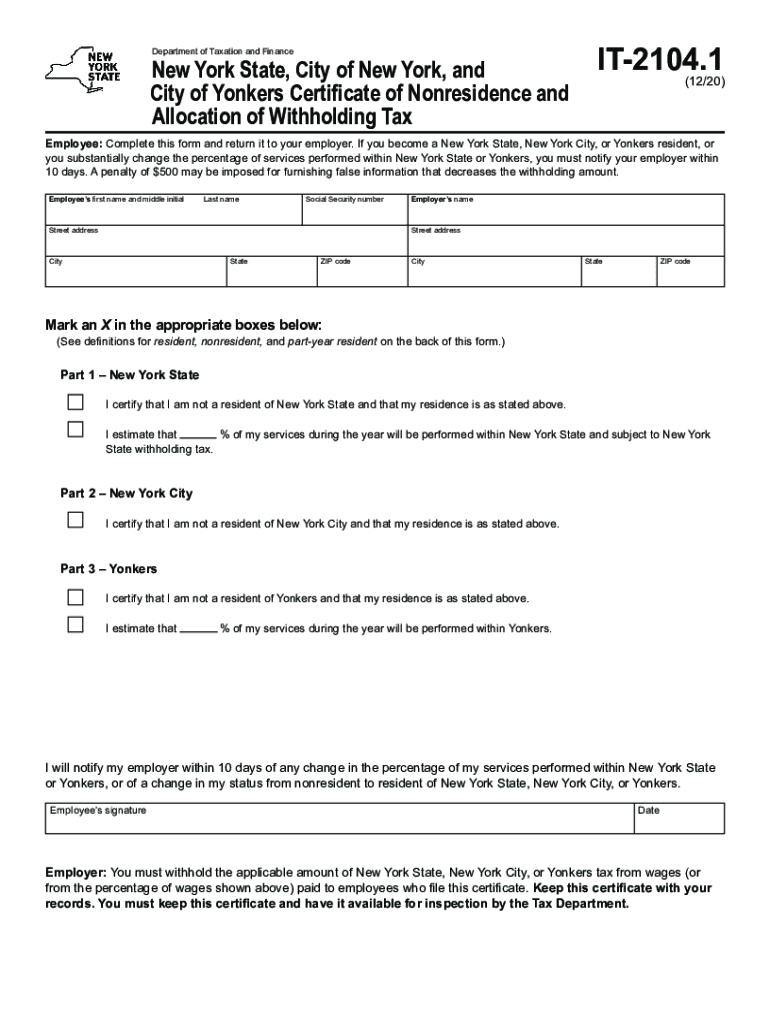

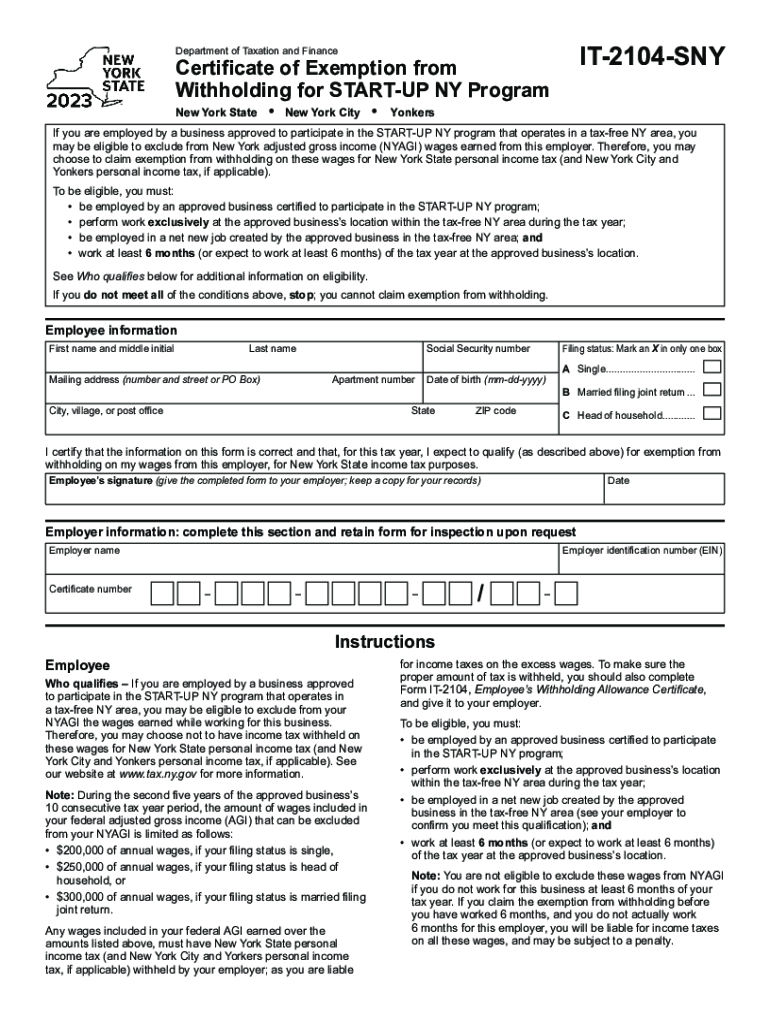

2023 It 2104 Fill Out Sign Online DocHub

It 2104 Worksheet Fill Online Printable Fillable Blank PdfFiller

It 2104 Worksheet Fill Out Sign Online DocHub

IT 2104 Step by Step Guide Baron Payroll